Every business decision can have substantial repercussions on the organizational efficiency and profitability. For instance, if a sales team accepts any project without collaborating with the delivery team, it can severely impact the overall quality.

At the same time, the said project will also add no value to the primary objectives and will utilize resources that can otherwise be allocated to a profitable and strategically aligned project. Thus, It will further eat up from the firm’s capital without generating any substantial revenue or tangible/intangible benefits.

The above example illustrates the requirement for a project selection criterion. Similarly, it is vital to follow a systematic approach for any investment that one makes, be it a new software / technology or specific service. Thus, a data-driven finance model will allow one to select the best possible solution out of multiple options.

One such technique is called cost-benefit analysis. It will allow you to make the best investment decision for your firm based on the principle of time value for money.

This article takes you through the key concepts constituting the analysis.

What is cost-benefit analysis?

Cost-benefits analysis is a financial model that considers both tangible and intangible benefits for decision making. Additionally, it considers the associated costs (fixed and recurring), and compares the two, yielding concrete results. Based on the procured values, managers will be able to make data-driven informed decisions about any investment.

If the benefits outweigh the cost, then it’s a feasible venture, and when the cost outweighs the benefits, one may need to rethink their decision. Overall, cost-benefit analysis is an invaluable tool for any organization to form the right business strategy, evaluate a new project, software, or any other purchase decision.

Cost-benefit analysis is an extensive calculation of multiple attributes such as the direct costs, indirect costs, real costs, and more. One of the most important factors to calculate before deducing the final cost is Total Cost of Ownership.

Below you will find its detailed description,

Why is it important to consider Total Cost of Ownership (TCO)?

The total cost of ownership is a financial estimate that facilitates decision-makers or buyers to calculate and determine the indirect and direct costs of an entity. Rather than only considering the purchase price of the product/entity, the TCO factors in the additional expenses like the cost price, the insurance, the maintenance or service costs, and so on.

For instance, if you are buying software, the TCO will factor the buying price, cost of the license, license renewal costs, training, data migration costs, software maintenance and support, configuration, and others.

So, the total cost of ownership is an integrated approach that considers the financials at a granular level and thus provide a precise value of the investment.

TCO is just one part of the cost-benefit analysis. Here is a step-by-step guide on how to do it with the utmost diligence,

How to conduct cost-benefit analysis steps?

In order to make the calculation precise, the cost-benefit analysis implementation caters to all the nitty-gritty of the investment. From formulating the right framework to calculating costs and benefits and even factoring in the risks, it covers it all. This is why it is one of the most preferred models for business decision-making.

Following are the steps you can take to get it right:

Formulate a framework based on your objective

Your framework is the foundation of the analysis as it outlines the goals and objectives of the particular endeavor you are evaluating. Let’s continue with the same example, you are planning to buy a software. What is your objective behind buying it? It can be either replacing the mundane tasks with automation, or replacing multiple legacy tools with a centralized platform, and so on.

So, the framework will be designed accordingly. It will emphasize the details and give a clear understanding of the costs and benefits as both are critical to determining the outcome. Also, keep in mind to decide all the necessary metrics you will be deploying to gauge and compare the costs and benefits. Furthermore, one needs to maintain a common currency for all the calculations.

Calculate the total cost of ownership and benefits

After developing the framework, the next step is to compile two separate lists of costs and benefits for each of the proposed investments.

-

Costs

In case of costs, the total cost of ownership will be an amalgamation of the following categories:

Direct costs

Direct costs are the expenses associated with the production of a product or development of a service or the purchase price of an investment. Labor costs, material costs, licensing costs, etc., are some of the examples.

Indirect costs

Indirect costs are mostly fixed in nature and consider the overhead expenditure of conducting the business such as utilities, rent, transportation costs, etc.

Tangible costs

Tangible costs are simple to quantify and have an identified source. For example, the direct and indirect costs are tangible costs.

Intangible costs

Intangible costs are qualitative in nature and difficult to quantify or measure in numbers. Some examples are the shifts in customer satisfaction, productivity levels due to the introduction of a new process, etc.

Opportunity costs

When decision-makers forego a project, product, strategy, or tool to select another option, they lose opportunities and benefits. These are known as opportunity costs.

-

Benefits

The benefits will be calculated on similar lines. Below is the rundown of different categories:

Direct

The measurable benefits you avail of from a project, service, or software, such as revenue, profit, or sales, are known as direct benefits.

Indirect

Indirect benefits are the qualitative benefits that one cannot measure but perceive. For instance, increased brand awareness or consumer base.

Intangible

Similar to indirect benefits, intangible benefits are not quantifiable. Improved employee morale or productivity are some of the examples.

Competitive

As the name suggests, competitive benefits are the ones you can avail of by being the first brand in the market to introduce a new product or service.

Draw a comparison between the cost versus benefits

After listing out all the costs and benefits, the next step is to draw a comparison between the two and get the final value. This is also known as Return on Investment. It is a financial metric that emphasizes the profitability of your investment relative to the investment’s cost.

The ROI is calculated using a simple formula:

Return on Investment (ROI) = (Current value of investment – cost of investment) / Cost of investment

Here, the current investment value implies the current year’s value or the benefits and cost of investment is the initial value invested.

Ideally, the ROI should be positive for you to invest in a product/service or software. If it’s negative, you might want to rethink your decision.

Please note that this ROI calculation does not take into account the time value of money.

With/without analysis

One more way to draw a comparison is a with/without analysis. For instance, if you are buying software, the ROI will depict the benefits. On the other hand, without analysis will give you a picture of your organization’s structure or scenario if you don’t buy the software.

This analysis strengthens the decision-making power by allowing you to weigh the scenarios in the absence and presence of the proposed entity.

Factor in the Necessary parameters

Let us define some of the financial terminologies that are needed to complete this analysis.

-

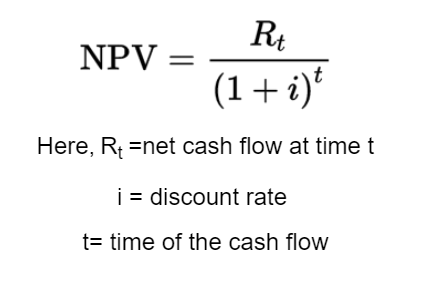

Net present value (NPV)

The net present value accounts for the time value of money and is calculated to determine the present value of the cash flow by taking the discount rate into account.

The discount rate is either the interest rate charged by the government or the rate used to discount future cash flows. If the NPV is positive, it implies your project or software will generate revenue in the long run, making it feasible, and the negative NPV calls for a re-evaluation.

-

Sensitivity analysis

Sensitivity analysis or a what-if analysis takes you one step further towards your analysis. You can change the value of some variables and study how it influences the overall value you deduced from the CBA. In other words, sensitivity analysis lets you factor in the risks you may encounter during the course of the project or any other investment. It analyzes the robustness of the CBA giving a more precise result.

-

Internal rate of return (IRR)

The internal rate of return is a financial metric implemented to evaluate an investment opportunity’s attractiveness. When you assess the IRR, you are practically evaluating the return rate after considering all the projected cash outflows while considering the net present value (NPV). The solution, software, or product that gives you the highest rate of return is selected over others.

Deduce a conclusion after diligent study of the results

Before drawing a concrete conclusion, the final step of the analysis is to consider all the external factors and risks that can impact the CBA results. These can be called the ‘wild-card’ issues that are not always deemed to happen but should keep an eye out for them.

Some of the risks involved are:

- Inaccuracies in the estimation of costs and benefits value can literally nullify the whole analysis.

- Cash flows are unpredictable that experience peaks and valleys, and thus putting a definite value on then can be challenging.

- Even though CBA allows you to put value or money sign on the intangible benefits, not all of them can be quantified.

- One stakeholder can value an intangible asset differently than the others. It’s a subjective entity.

- Relying on the previous project’s data can prove futile as the values vary based on the discounted rates and other factors.

Once you are thorough with all the calculations, it is time to do a final comparison between the cost-benefit ratio of different options and select the most cost-effective one.

To make these complex concepts simpler to understand, here is a real-life example of cost-benefit analysis.

The real-world example of cost-benefit analysis- Buying a resource management software

Disclaimer: This example is a decision-making model designed to explain to the users the significance of CBA in helping you make the right investment. This particular model is designed to explain its utility in software selection. The type of costs and benefits integrated into the sheet may vary for different organizations based on their needs and requirements. We have used some fictitious values to demonstrate this concept. It will be necessary to take help from the SMEs and business users to quantify numerical values out of the Intangible benefits.

How to use CBA to buy the right resource management software?

Let us suppose you are planning to invest in resource management software. Of course, since there are tools available in the market for this purpose, the first step will be to compare similar products and draw a conclusion. For this purpose, we have developed an excel that explains how a cost-benefit analysis can prove fruitful to help you make the right decision.

As the first step after forming the framework is to calculate the costs and benefits separately, we have followed suit.

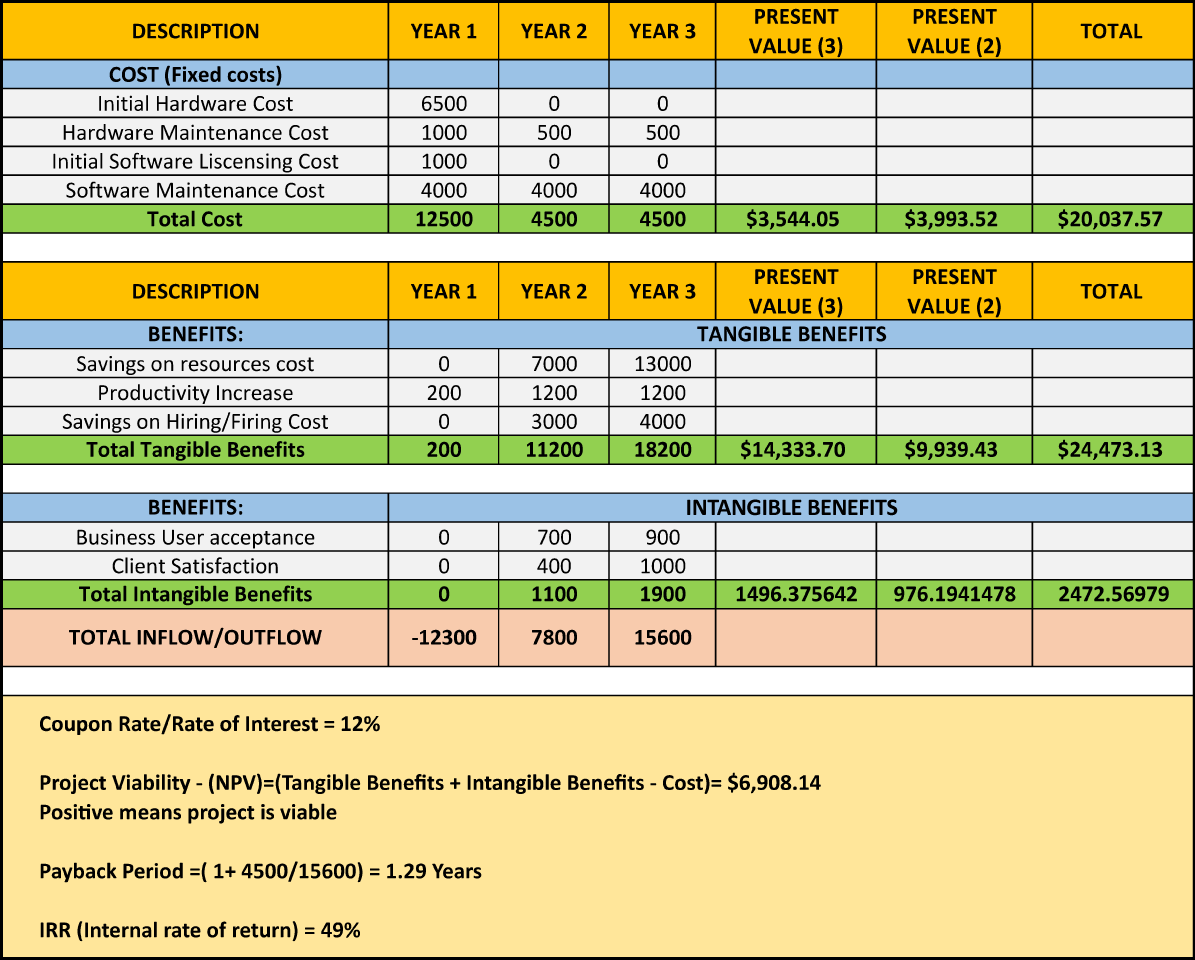

Cost:

The first-purchase cost of the software include:

- Hardware cost – $ 6500

- Hardware maintenance cost – $1000

- Initial software licensing cost – $1000

- Software Maintenance cost – $4000

Total costs= $12500

Only maintenance costs will be incurred in the following years as the hardware installation and licensing is a one-time cost. So, for the next two years the cost will be:

- Hardware maintenance cost – $500

- Software Maintenance cost – $4000

Total costs for 2 years = $4500*2= $9000

However, these values are based on the current rates and have not factored in the future discount rate. So, now the next step is to calculate the present value of the second and third year with a future discount rate of 12%. These values are calculated using the excel formula.

The values will be,

- The present value of 2nd year= $3544.05

- The present value of 3rd year= $3993.53

After listing out and assessing all the parameters, the final step is to sum up the costs of these years and calculate the total cost of ownership which comes out to be $ 20,037.57 in 3 years.

Benefit:

After getting all the costs in place, the next step is to list all the benefits carefully. Since it’s a resource management software, the first tangible benefit to look at is reducing resourcing costs, followed by a reduction in hiring/firing costs and an increase in employee productivity.

You will not experience any visible savings on resource and hiring/firing costs in the first year because setting up a resource management strategy and forming a resource plan takes time.

- Savings on resources cost- $0

- Productivity Increase- $200

- Savings on Hiring/Firing Cost- $0

In the next following years, the benefits will look like,

- Savings on resources cost- $7000 + $13000

- Productivity Increase- $1200 + $1200

- Savings on Hiring/Firing Cost- $3000 + $4000

Similar to the pre the next step is to calculate the present value of the second and third year with a discount rate of 12% using the excel formula.

The values are:

- The present value of 2nd year= $14333.70

- The present value of 3rd year= $9939.43

The intangible benefits can be only be perceived after the software is utilized for a year. Qualitative benefits are long-term effects and, in this case, client satisfaction and user acceptance are the ones. This is because deploying a resource management system leads to the timely completion of projects result in enhanced customer experience. Additionally, the software is user-friendly as it provides real-time unified visibility and a smooth user interface, thus increasing the user-acceptance.

- Business User acceptance – $700 + $900

- Client Satisfaction – $400 + $1000

The present value for the above benefits is as follows:

- The present value of 2nd year= $1496.375

- The present value of 3rd year= $976.194

After calculating and summing up all the values of both tangible and intangible benefits, the total was $ 26935.74.

Final calculations and comparison:

After calculating the costs and benefits, the ROI, NPV, IRR, and payback period were calculated to see the definite cost to benefit ratio.

The first step here is to evaluate the Returns. So, considering the net present value of the costs and benefits,

The return will be,

Total Benefits (tangible + intangible) – Costs = $ 26935.74 – $20,037.57= $ 6908.14

After deducting the costs, the positive value of the returns indicates a green signal to go ahead with the software.

We also calculated the internal rate of return using the NPV formula and making the NPV zero.

The IRR was 49% which is substantial enough to go ahead with the investment. This needs to be higher than the discount or the coupon rate.

The payback period of the software came out to be 1.29 years. It indicates that the benefits will be higher than the costs after 1.29 years and the investment will generate revenue.

This financial data proves that it makes sense in investing in a resource management software

Conclusion

You can draw a similar sheet for all competitor products, carry out the cost benefit analysis for each and derive a conclusion based on the results.

The software with the highest returns, best IRR, and the lowest payback period is the right choice for this purpose.

At the same time, if you are planning to build software on your own rather than taking a third-party tool, you can carry out a Build vs. Buy cost-benefit analysis.

It will give you a clear picture of the cost vs. benefit ratio for building the product against the value of CBA if you buy it.

This additional comparison will give you a 360-degree picture of the returns of investing in new technology and add an extra layer of precision.

Now that it is fairly clear on how to conduct a full-fledged cost-benefit analysis, here is a wrap-up of all the pros and cons of this model that you must keep in mind.

Conclusion- Advantages and disadvantages of cost-benefit analysis

Even though cost-benefits analysis is one of the most accepted financial decision-making models amongst businesses, it has its own set of disadvantages. Here is a compiled list of both,

Advantages

- The cost-benefit analysis offers an agnostic and evidence-based assessment of your multiple prospects, enabling you to become more data-driven.

- Cost-benefit analysis can be used in multiple scenarios like project selection, software investment, evaluating recruitment decisions, setting standardized protocols to compare and select the right project, etc.

- The analysis reduces the complexity of business decisions by categorizing all the costs and benefits and calculating each entity individually.

- The fact that cost-benefit analysis factors in indirect and intangible costs and benefits make it more accurate and granular.

Disadvantages

- Even though cost-benefit analysis puts value to all attributes, certain business parameters are unpredictable, such as market volatility, change in market demand, material costs, etc.

- CBA is completely data-centric, so if your data is based on pure guesstimations, this entire analysis is futile and error-prone.

- This analysis is only beneficial for short-term or medium-term projects because the longer the duration, the more are the chances of inaccuracies in economic predictions. For example, discount rates, inflation, etc.

- There are unpredictable, immeasurable human elements that are not catered to while conducting a cost-benefit analysis. For instance, one may decide to go ahead with a project due to humane reasons and not numbers. Obviously, this cannot be reconciled with this business case model.

If followed and implemented meticulously, CBA can prove to be a boon for your business and enhance your project or software, or product inventory. If not, it can take the progress downhill. So, avoid overlooking any attribute because every small number added can change the ratio substantially.

What decision-making model do you follow to make a suitable investment?

Glossary

SAVIOM Solution

SAVIOM is the market leader in providing an Enterprise Project Resource Management solution. With over 20 years of experience leading the market, Saviom is actively used by over 15 highly-esteemed global companies worldwide. The tools within the suite include project portfolio management, professional service automation, and workforce planning software. It also entails supporting solutions to schedule equipment and assets seamlessly. Re-engineer your project management efficiency with a system shaped around your business!